Toward blockchain-powered FinTech?

In this article, I try to explain why I believe blockchain technologies have the potential to become the next generation of Fintech.

What is FinTech?

FinTech (Finance Technologies) describes technologies that aim to improve and innovate in the financial industry from retail banking to regulation, payments, insurance, credits, and many more. This term appeared after the 2008 financial crisis when many actors of the finance decided to leave big banks and rethink the system.

Banking has been around for quite some time if forever, but the least we can say is that they’ve missed the technological bus over the past two decades and today we see archaic interfaces in the hands of customers and staff. The banking experience sucks in many ways, it’s a black box driven by manual processes and arbitrary rules in geographically localized areas (branch). Even though, our modern society moves toward more transparent, automated, digitalized, and borderless systems for everything including banking.

One of the most important breakthroughs of FinTechs is mobile banking, there has been a large number of challenger banks emerging globally and offering a decent experience more adapted to millennials’ habits in comparison to legacy banks.

Another important improvement is that FinTechs took one of the successful recipes of the modern Web: rather than building from scratch complex systems in a closed environment, they built opened systems (generally known as API or SaaS) abstracting some services and allowing other businesses to benefit from it in exchange of a subscription fee. Why this is a big deal because it allows startups to build faster and focus on their core idea, this is similar to how Cloud Computing (AWS, GoogleCloud, etc.) abstracted the concept of a server, the cloud provider gives you access to a “virtual” service while taking care of the maintenance of this service in exchange of a fee generally proportional to the usage. Here, this is the same thing, some FinTechs are focusing exclusively on giving you access to highly reliable backend services (for payments, core banking APIs, regulatory software) creating a connected ecosystem made by many actors in the sector so you can develop faster by composing those services together (think Lego).

I’d like to share two concrete examples of opened financial systems being largely used in the EU and USA:

- Open-Banking: Traditional banks are trying (or being forced) to catch up with the technological bus and they started to open up their systems to external applications (through APIs to retrieve account information and initiate payments). An Open-Banking platform represents a SaaS that aggregates connections with as many banks as possible to offer a single endpoint to access data from hundreds of banks and financial institutions. So it doesn’t matter if your end-user has a bank account with Barclay, Lloyds, or Revolut, the OpenBanking software abstracts these connections to you and connects your application to your user’s bank account.

- Bank as a Service: BaaS platforms abstract the entire core-banking engine which are the processes and services to offer things like accounts, IBAN, payments, KYC, cards, and more. These platforms are white-labeled and ready-to-use APIs to delegate the infrastructure of the bank to the BaaS provider while focusing on the customer-facing part and experience.

This results in a new trend in the FinTech sector called “Embedded Finance” because any applications can now integrate a bunch of financial services very easily and offer in-app e-money wallets, pay-in/pay-out payments, debit cards, stock trading, robot advisor, and more.

In conclusion, FinTechs are rethinking Finance with modern and interoperable software allowing better synergies to break barriers, build faster, and automate processes. This a true revolution in the financial sector which is well-known for being reluctant to change. But still, FinTechs have their roots hooked to our complex, slow, and sometimes corrupted global finance system. It’s not particularly inclusive nor transparent (as we recently witnessed during the GME/RobinHood debacle), it’s also tied to local regulations (USA, EU, etc.) making global access more difficult for people in third-world countries, especially unbanked.

What is Blockchain & DeFi?

Ethereum is a public blockchain. Just like Bitcoin, it is a distributed ledger allowing anyone to send and receive digital money, a cryptocurrency called Ether (ETH) through a decentralized and global peer-2-peer network with the advantage of being fully-public, pseudo-anonymous, and censorship-resistant.

But Ethereum also provides smart-contracts exploiting the above properties and offering a platform to develop and store information and assets. It makes a huge difference compared to Bitcoin because this enables anyone to build decentralized, global, and unstoppable applications which can communicate together and exchange information and assets. These Dapps (Decentralized Apps) can also be financial services because (regulation aside) financial services are information and assets stored somewhere and orchestrated by rules and processes (so why not an autonomous program).

Over the past few years, enthusiastic entrepreneurs, researchers, developers, and hackers have started rethinking the financial infrastructure from the ground up using blockchain and smart-contracts technologies such as Ethereum. Many names have been given to this such as Open Finance, Automated Finance but in the end, the term DeFi (Decentralized Finance) has been adopted.

DeFi represents an ecosystem of open applications and protocols which interact with each other and offers financial products like stable-coins (fiat-pegged cryptocurrency), asset exchanges (swap), lending & borrowing (through collateralized loans), derivatives, and more.

This new paradigm isn’t yet mature and despite many advantages and progress made in the past few years, the blockchain has some drawbacks: it doesn’t scale yet (ability to process millions of transactions per day), consumes too much energy (Proof of Work) and is generally too complex to use for the average Joe with too many risks of mistakes or hacks.

Why DeFi might be the future of FinTech?

So why do I believe blockchain technologies could become the backbone of FinTech in the future. Innovation is always driving technologies and the more open, accessible, and interoperable the technology is, the more entrepreneurs and builders will imagine new ideas and build brand new systems to solve the problems of today. The following key aspects of this new technology should inspire all the actors of FinTech:

Opened-by-default: As we saw earlier, banks are forced to open up their systems and allow third parties to access their data to enhance financial services. Blockchain and smart-contracts are interoperable, you don’t need to ask for permissions, pay fees, endlessly discuss with sales to access the data, and integrate your app to a protocol.

Open-Source: Open-source projects are generally maintained by a strong community of passionate and talented people. The power of the crowd offers better reliability, trust, and security into the software reviewed by many eyes. While banking systems have been known for running on expensive proprietary (close-source) solutions; smart-contracts, on the other hand, make financial services open-sourced by design and accessible to all for free.

Transparent: While regulation of blockchain-based financial systems isn’t yet clear. Blockchains act as a public and single shared source of truth for all network participants. Regulators should welcome this level of transparency helping them with traceability, reporting, and monitoring.

Permissionless: No matter your background and location you can join the network and start building on top of it. You may want to build services for your local community or anyone breathing on earth: doesn’t matter, it’s permissionless and global.

Autonomous: Programmability behind smart-contracts can improve efficiency and automate processes in a tamper-proof and deterministic way. This kind of processing power has the benefits to reduce the counterparty risks: important operations are happening on-chain with instant settlement and doesn’t rely on external parties anymore.

Conclusion

In conclusion, a new generation of FinTechs powered by blockchain is coming and is going to bring significant value to the sector. Payments could be processed with better security and lower cost across the world, investments and credits products will be accessible to anyone reducing frictions and countless intermediaries between consumers and financial institutions, and finally, regulators will enjoy complete transparency to meet compliance.

This is still early days, of course, not everything can be solved by blockchain and many challenges remain, blockchain technologies are far from maturity (scalability, speed, UX, privacy) and despite great properties, we cannot tell if regulators and central banks will fully adopt it.

But the properties offered are expanding the scope of possibilities of FinTechs toward more inclusive, transparent, and open technologies.

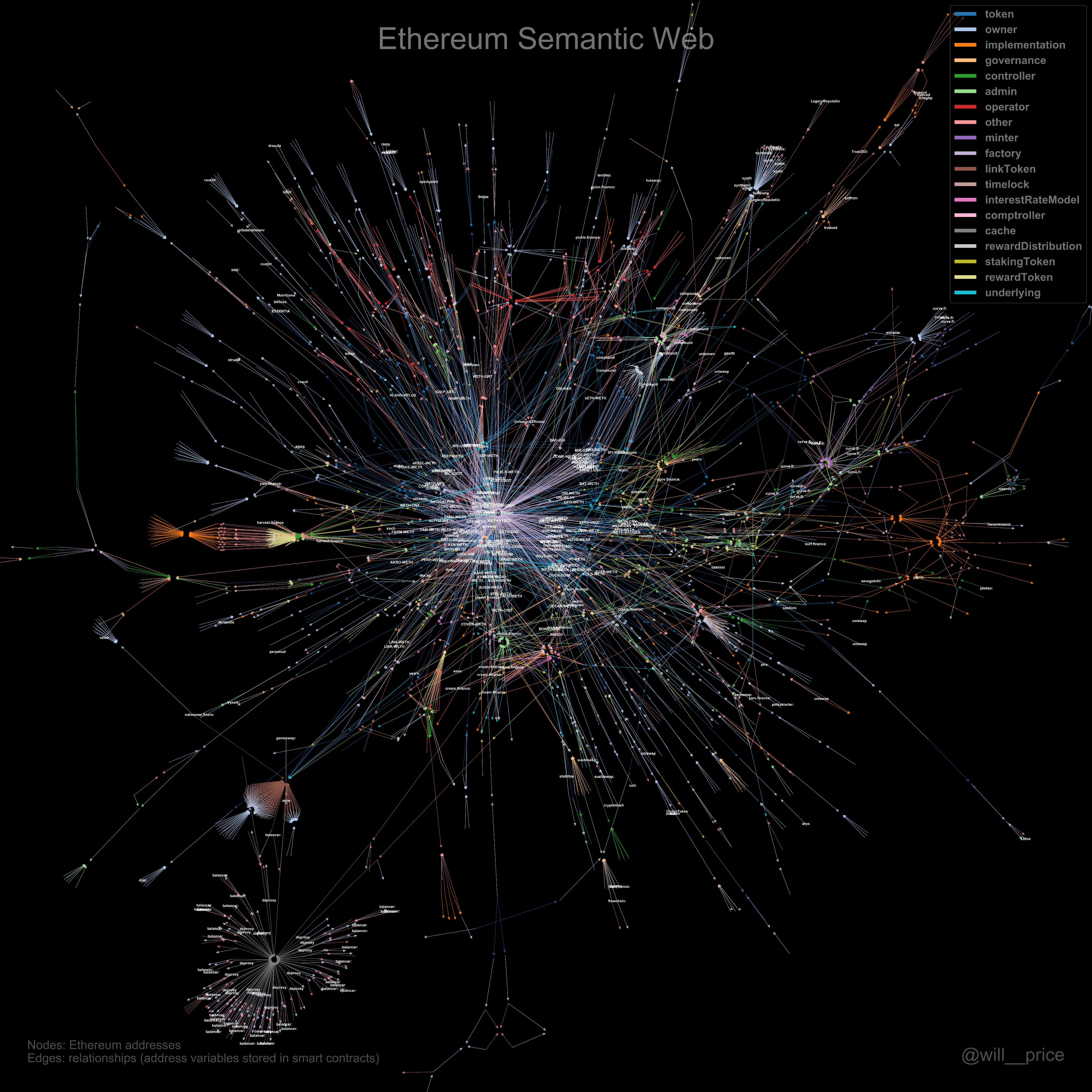

Representations of the connections between protocols and apps in the Ethereum/DeFi space (source)